What is an AI Trading Bot Assistant? Everything You Need to Know

AI/LLM (OpenAI, ChatGPT) Trading Bot Assistants are sophisticated digital tools that leverage the power of advanced artificial intelligence (AI) and large language models (LLMs) to assist traders in navigating the complex world of financial markets. These assistants are designed to analyze market data, identify patterns, and provide personalized insights and recommendations to help traders make more informed decisions.

By harnessing the capabilities of cutting-edge AI technologies, such as those developed by OpenAI and other leading research institutions, these trading bot assistants can perform a wide range of tasks, including market research, risk assessment, portfolio optimization, and even automated trading strategies. They can quickly process vast amounts of data, identify trends and anomalies, and generate actionable insights that can give traders a competitive edge in the market.

These AI-powered trading assistants are particularly valuable for traders who seek to enhance their decision-making process, reduce the impact of human biases and emotions, and ultimately improve their trading performance. By seamlessly integrating with various trading platforms and data sources, these tools provide a comprehensive and intelligent solution for modern traders who strive to maximize their returns and minimize their risks.

AI Trading Bot Assistant Use Cases

How do AI trading bot assistants differ from traditional trading strategies?

What are some of the key features and capabilities of advanced AI trading bot assistants?

How can users effectively leverage and integrate AI trading bot assistants into their investment strategies?

What are some of the ethical and regulatory considerations surrounding the use of AI trading bot assistants?

Example of AI Trading Bot Assistant Tools

Conclusion

AI Trading Bot Assistant Use Cases

AI Trading Bot Assistant Use Cases

- #1

Utilizing AI trading bot assistants to analyze market trends and make informed decisions on buying and selling stocks in real-time

- #2

Implementing AI trading bot assistants to automate the process of monitoring multiple financial instruments simultaneously for optimal investment opportunities

- #3

Leveraging AI trading bot assistants to backtest trading strategies and optimize performance based on historical data

- #4

Integrating AI trading bot assistants with advanced machine learning algorithms to predict price movements and execute trades with high accuracy

- #5

Using AI trading bot assistants to receive personalized recommendations and alerts based on individual risk tolerance and investment goals

How do AI trading bot assistants differ from traditional trading strategies?

How do AI trading bot assistants differ from traditional trading strategies?

AI trading bot assistants differ from traditional trading strategies in several key ways. While traditional strategies often rely on manual analysis, pre-defined rules, and human decision-making, AI trading bots leverage machine learning algorithms to continuously analyze market data, identify patterns, and make real-time trading decisions. This allows them to respond more quickly to market changes and potentially identify opportunities that may be missed by human traders. Additionally, AI trading bots can operate 24/7, executing trades without the constraints of human fatigue or emotion, potentially leading to more consistent and systematic performance.

What are some of the key features and capabilities of advanced AI trading bot assistants?

What are some of the key features and capabilities of advanced AI trading bot assistants?

Advanced AI trading bot assistants often include a range of sophisticated features and capabilities, such as:

- Predictive analytics: Leveraging machine learning models to forecast market trends, price movements, and other key indicators that can inform trading decisions.

- Automated execution: The ability to automatically execute trades based on predefined parameters or real-time market conditions, without the need for manual intervention.

- Adaptive strategy optimization: The capacity to continuously learn and refine trading strategies based on market feedback, improving performance over time.

- Risk management: Incorporating robust risk-mitigation strategies, such as stop-loss orders and position-sizing algorithms, to help manage and minimize potential losses.

- Multi-asset support: The capability to monitor and trade across a diverse range of financial instruments, including stocks, currencies, commodities, and cryptocurrencies.

- Backtesting and simulation: Allowing users to test and validate trading strategies using historical market data before deploying them in live trading environments.

How can users effectively leverage and integrate AI trading bot assistants into their investment strategies?

How can users effectively leverage and integrate AI trading bot assistants into their investment strategies?

To effectively leverage and integrate AI trading bot assistants into their investment strategies, users should consider the following:

- Understand the underlying algorithms and decision-making processes: Gaining a clear understanding of how the AI trading bot operates, its strengths, limitations, and potential biases can help users make informed decisions about its deployment and use.

- Customize and fine-tune the bot's parameters: Many AI trading bot assistants allow for a high degree of customization, enabling users to tailor the bot's behavior to their specific trading goals, risk tolerance, and market conditions.

- Implement robust risk management protocols: Users should ensure that the AI trading bot assistant incorporates effective risk management strategies, such as stop-loss orders and position-sizing algorithms, to help protect against significant losses.

- Monitor and review the bot's performance: Continuously tracking the bot's performance, analyzing its trades, and making adjustments as needed can help users optimize the bot's effectiveness and ensure it aligns with their investment objectives.

- Diversify and complement the bot with other trading strategies: While AI trading bot assistants can be powerful tools, they should be considered as part of a broader, diversified investment approach, rather than as a sole or primary trading strategy.

What are some of the ethical and regulatory considerations surrounding the use of AI trading bot assistants?

What are some of the ethical and regulatory considerations surrounding the use of AI trading bot assistants?

The use of AI trading bot assistants raises several ethical and regulatory considerations that users should be aware of:

- Transparency and explainability: There is a growing emphasis on the need for AI systems, including trading bots, to be transparent in their decision-making processes and able to provide explanations for their actions. This can help build trust and accountability.

- Algorithmic bias: AI trading bots may inadvertently reflect biases present in their training data or programming, which could lead to unintended and potentially discriminatory outcomes. Careful monitoring and mitigation of these biases is crucial.

- Regulatory compliance: Users must ensure that their use of AI trading bot assistants adheres to relevant financial regulations, such as those governing market manipulation, insider trading, and best execution practices.

- Data privacy and security: The collection and use of sensitive financial data by AI trading bots raises important data privacy and security concerns that must be addressed through robust data governance and protection measures.

Example of AI Trading Bot Assistant Tools

Example of AI Trading Bot Assistant Tools

CoinScreener

CoinScreener is an AI-powered crypto trading platform that provides users with real-time insights, trading signals, and advanced analytical tools to help them make informed decisions in the cryptocurrency market.

investiment.io

investment.io is an integrated generative AI solution that helps investors and traders elevate their trading decisions by providing insights and analysis on news, earnings calls, and financial data more efficiently.

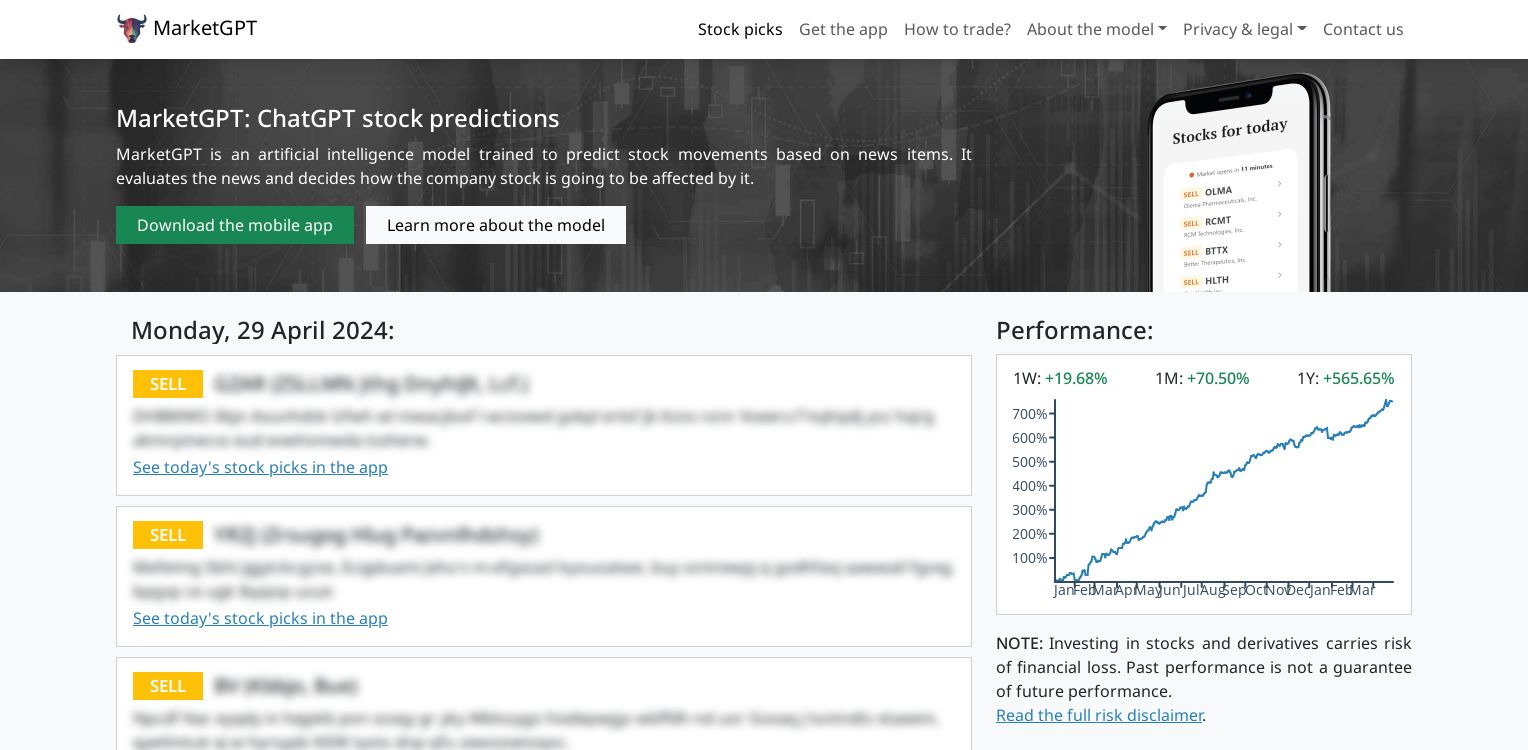

MarketGPT

MarketGPT is an artificial intelligence model trained to predict stock movements based on news items. It evaluates the news and decides how the company stock is going to be affected by it.

Conclusion

Conclusion

AI/LLM Trading Bot Assistants have emerged as powerful tools that leverage advanced artificial intelligence and large language models to aid traders in navigating the complex financial markets. These assistants can perform a wide range of tasks, from market analysis and trend identification to automated trading and risk management, providing traders with a competitive edge.

Key features of these AI trading bots include predictive analytics, automated execution, adaptive strategy optimization, robust risk management, and the ability to monitor and trade across a diverse range of financial instruments. By integrating these assistants into their investment strategies, users can enhance their decision-making process, reduce the impact of human biases, and potentially improve their trading performance.

However, the use of AI trading bot assistants also raises ethical and regulatory considerations, such as the need for transparency, the mitigation of algorithmic bias, compliance with financial regulations, and the protection of data privacy and security. As these technologies continue to evolve, it will be crucial for users to carefully evaluate and integrate these tools within a broader, diversified investment approach.